1

Coinbase Mistake-Whenever some major problem occurs with a crypto exchange, we will be reading about it everywhere the next day.

1.1

This is not a good face for crypto exchanges, so they are always trying to not let the news get out but usually, they fail to do so.

1.2

So it is surprising that today we are not reading about the things that went down on August 30, on Coinbase.

2 Coinbase Mistake

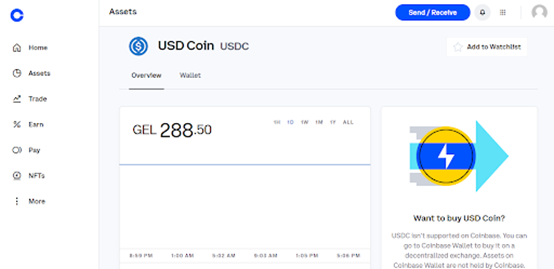

First reported by investfox.com, on August 30, Coinbase had a major technical bug that gave traders the opportunity to sell their cryptocurrencies for 100 times the price. This technical error occurred for those who used GEL (Georgian national currency) as their account currency. Traders who had crypto prices and their account balances displayed in GEL saw that their balances were showing astronomical prices.

3

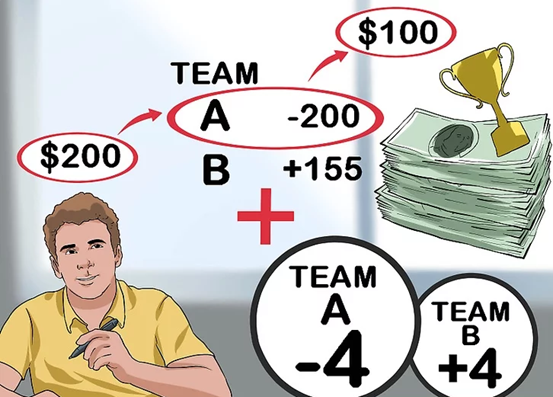

So what exactly happened? Coinbase is a US-based crypto exchange that primarily uses USD as the currency on their exchange, but they also allow traders to display balances in different currencies for traders’ convenience. For this, they need to implement exchange rates of different currencies with USD, and that is where the problem occurred. On August 30, the average exchange rate of USD and GEL was 1 USD for 2.88 GEL, so if traders had 10 USDC in their accounts and wanted to sell it for GEL, they should have received 28.8 GEL following the exchange rate. But in fact, traders were able to sell 10 USDC for 2880 GEL.

4

Here we can easily see where the problem occurred. Coinbase had a technical error that caused the exchange rate of USD and GEL to be set as 1 USD for 288 GEL. This was not present for only USDC, but every single cryptocurrency on Coinbase was priced for 100 times more than the market price.

Traders were able to take advantage of this mistake and sell huge quantities of cryptocurrencies on Coinbase for astronomical prices. Most of these traders transferred their cryptos from different exchanges to Coinbase and sold them there. It is not yet known how much money exactly has Coinbase lost following this technical error, as they still remain silent regarding the issue and no comments have been issued.

On the traders’ side, things are also not as good as you might think. Following these huge deposits, most Georgian banks started flagging the transactions as suspicious activity and stopped accepting any more deposits from Coinbase. This response from banks was really fast and because of that, a lot of traders didn’t manage to withdraw funds from Coinbase. Shortly after this, banks started to freeze accounts that received payments from Coinbase. Reports suggest that this was initiated by banks themselves and not following the request from Coinbase.

Following these developments, Georgian traders who managed to take advantage of this error became vocal and demanded that their accounts be unfrozen. The main problem here is that banks freeze accounts and not the funds received, so traders can not access other funds they had in their accounts. Another reason for this outrage from traders is that they believe that they have done nothing wrong and the money they made legally belongs to them, and they have quite good reasons for that.

One reason is that this is a financial exchange, and they were offering to pay certain money for certain assets. Combine this with one of the most famous trading strategies, arbitrage trading, which is when you find price differences between two exchanges and take advantage of that difference to make profits, and we see where they are coming from. Georgian traders believe that they have not done anything wrong and just followed the legal and accepted trading strategy of arbitrage.

So we still don’t know what awaits these traders. Will they keep the money they made, or will Coinbase manage to convince banks to refund transactions? All that is left for these traders to do is wait for further developments.

U.TOWN:https://u.town/en