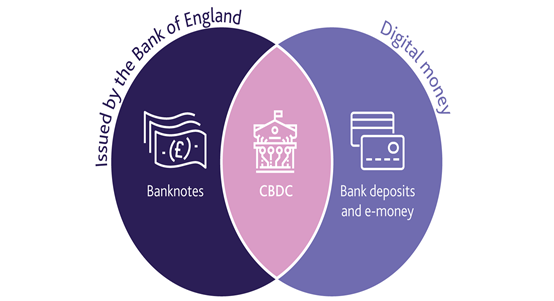

cryptocurrency Central bank-backed digital currencies, such as the potential digital euro and digital yuan, may become a reality in the coming years. Unlike cryptocurrencies such as Bitcoin and Ethereum, these currencies promise less volatility and greater security. In addition, they will have the support of their respective monetary institutions, responsible for ensuring financial stability.

Centrally issued currencies backed by central banks

Unlike these two cryptocurrencies, which also have DLT (distributed ledger technology), officially backed digital currencies will be issued centrally and will be backed by their central banks. “One of the differences between a digital euro and a Bitcoin is the way they are issued. While the operations, in the case of the euro, are centralized and the only one that can issue it is the ECB, in the case of a Bitcoin it is totally different,” says Alberto Muñoz Cabanes, Professor at the Department of Applied Economics and Statistics at the National Distance Education University (UNED).

Cryptocurrencies backed by corporations

It is also worth mentioning that digital currency projects not backed by central banks, but by corporations are subject to regulation, such as Libra, now Diem, the cryptocurrency project backed by Facebook. “There are other types of solutions that seek to combine the innovative functionalities found in cryptocurrency networks with greater guarantees for users,” says Español.

These types of currencies are backed by an asset reserve of the institution that issues them and can be less risky than cryptocurrencies as a means of payment. “However, we must bear in mind that, given the novelty of these proposals, the authorities are currently analyzing them and, where appropriate, adapting financial regulation to accommodate these types of solutions,” explains the BBVA economist.

Español also stresses that “these types of solutions, when they have a global reach and a large number of users, pose significant challenges to financial stability due to their systemic importance.”

In search of primacy in digital currencies

The People’s Bank of China, the equivalent of the ECB in Europe, has been running tests of its digital currency since April with the help of four banks in the country. Given the strength that the two Asian technology giants, WeChat and Alipay have acquired in the digital payments environment, China wants to take control from now on, seeing how well these means of payment have worked in the country. Their aim is to have the digital yuan be fully operational by 2022. In the longer term, the Chinese government plans for its digital currency to replace its physical currency across the country.

At an international level, the Asian giant is looking towards a hypothetical scenario in which its digital yuan would become the world´s preferred currency. “The fact of being the first to launch your digital currency allows you to eliminate internal problems, such as ´black money,´ while increasing your fiscal efficiency, since tax payments would be immediate. It would also allow the speeding up of trade, because payments are instantaneous,” explains Muñoz, who underlines the importance that a currency of this type could have on international transactions. The convenience of this type of digital payment could act as a stimulus for rapid adoption by those involved.