Welcome to Lazyfarm NFT!

Lazyfarm NFT is a collection of cute and unique Ethereum-based NFT collections. Lazyfarm’s first NFT project, Archie & Jo, consists of 10k NFTs, each one with a distinct feature. Lazyfarm’s characters have solid and endless stories. In addition, we plan to maximize the usability of NFT through active gamification and production of NFT-based merchandise. Discover the limitless allure of Lazyfarm NFT and join the Lazyfarm community today!

What is Lazyfarm?

Lazyfarm is a farm in virtual reality where cute and lovely characters live together. Unlike the standardized and exploitative farms in the real world, all the characters in Lazyfarm live a peaceful life with their own unique identity. Characters who have experienced a centralized and arbitrary past have created a decentralized community against it. On these equal farms, the Lazy Fam are self-sufficient by working cooperatively with each other. Join us now to create a more peaceful farm!

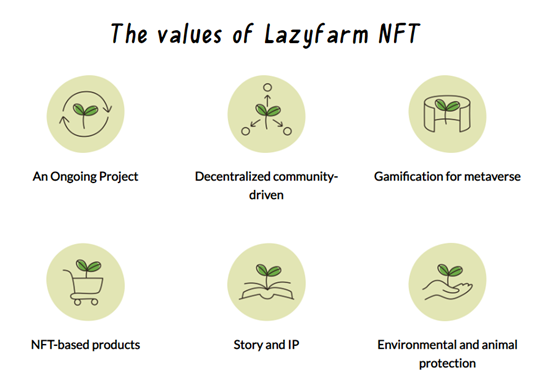

An Ongoing Project

- Lazyfarm is a collection of lovable characters that exist in the Metaverse.

- A range of unique characters will follow after the initial, Archie & Jo.

- We plan to expand Lazyfarm’s ecosystem with various character designers.

- Operate an ongoing NFT project for the community.

Decentralized community-centric

- All Lazy Fam members will be treated as equals.

- The community of Lazyfarm is of the highest importance.

- We plan to build a DAO using our own token for the community to contribute their ideas. Projects will have transparency and will reflect the feedback of the community.

Games in the Metaverse/Virtual Reality

- The Lazyfarm NFTs are utilizable characters within virtual reality.

- We plan to develop an open-source game for the NFTs.

- We plan to build Lazyfarm on established Metaverse platforms such as The Sandbox, Decentraland, My Neighbor Alice, etc.

- The games will be based on the Lazyfarm lore for an enjoyable story-driven experience.

NFT-based products

- The Lazyfarm characters will appear as real-world products.

- The products will include but are not limited to stickers, calendars, apparel, and figures.

- We aim to approach and educate people unfamiliar with Crypto through Lazyfarms characters.

Story and IP

- Each character in Lazyfarm has a unique story.

- With these characters, we plan to make products such as emojis, webtoons, picture books, etc.

Environmental and animal protection

- Lazyfarm is at the forefront of environmental and animal protection.

- We will inform people about the importance of the environment and animal rights through various stories and content.

- A portion of Lazyfarm NFT’s revenue will be donated to environmental and animal protection organizations.

- U.TOWN:https://u.town/en